Business Insurance in and around Fremont

Calling all small business owners of Fremont!

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes mishaps like a customer hurting themselves can happen on your business's property.

Calling all small business owners of Fremont!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

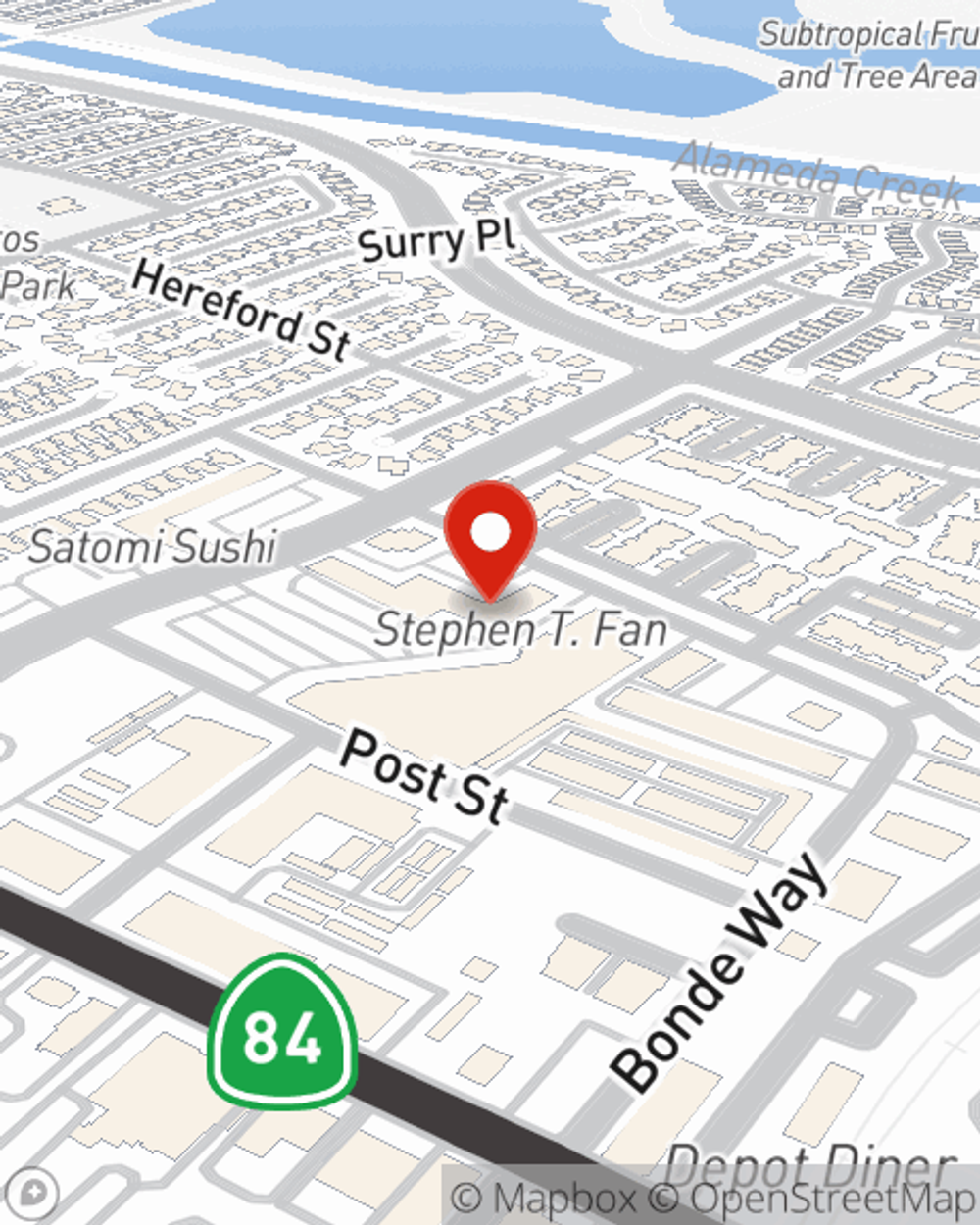

With State Farm small business insurance, you can give yourself more protection! State Farm agent Ninna Chugh is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Ninna Chugh can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let the unknown about your business keep you up at night! Call or email State Farm agent Ninna Chugh today, and discover the advantages of State Farm small business insurance.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Ninna Chugh

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.